Business BOI Report Requirements: How To File BOIR

See the new BOI Report requirements to maintain your business compliance. Keep reading to see the complete step-by-step guide. Then, file the BOIR (Business Ownership Information Report). With this in mind, here is your complete U.S. guide step-by-step with pics. However, reporting requirements changed a lot in 2024 & 2025. So, keep reading for the details on BOIR filing. Also, this is a part of our Blog Planning category & mentioned in our “How Do You Start A Blog The Best Way Now” article.

Business Alert: Guess what? You might not be required to file a BOI Report! Check to see “Is BOI Filing Still Required?“. Regardless, this article gives you the insight into how to file your own BOI Report.

What is a BOI Report?

A BOI Report is a Beneficial Ownership Information Report. Some companies & LLCs must file one. Here’s the federal government’s BOIR FAQ (Frequently Asked Questions). It’s a great set of common questions & answers with some explanations about it. Also, see reporting due dates. Finally, it has some good helpful links.

Important BOI Report Guides

- How to File Updated BOI Report Online

- Is BOI Filing Still Required? – Always see the latest requirement

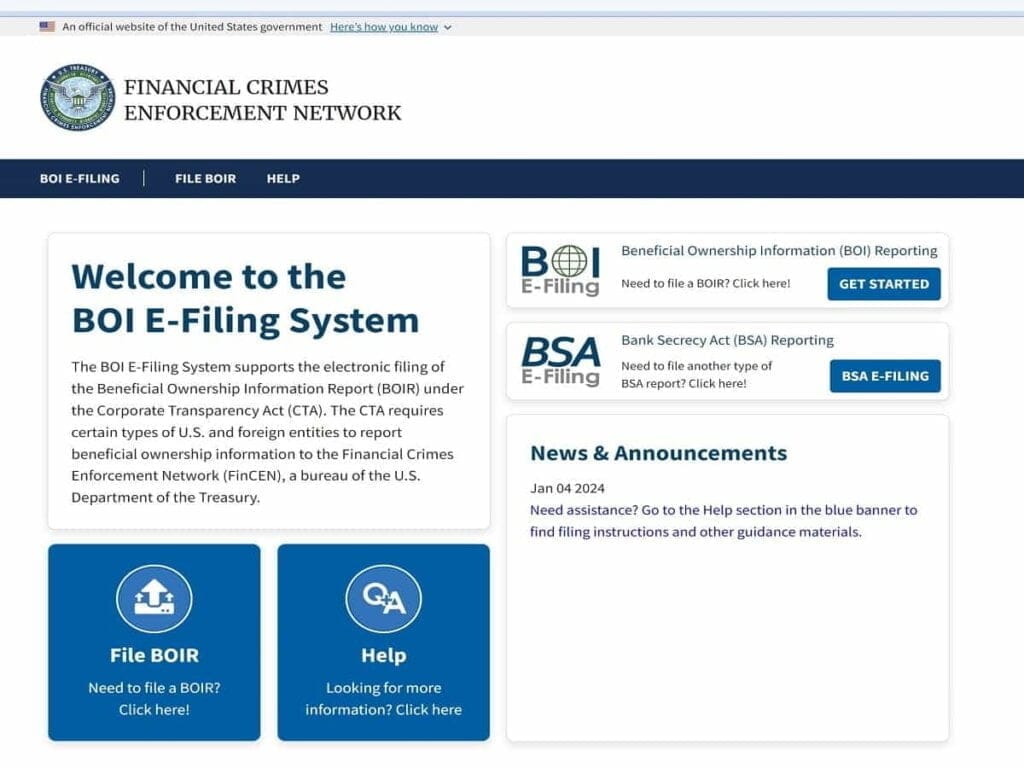

Example Home Site Image of BOI E-Filing System

Why Do BOI Report Requirements Exist?

Basically, the purpose of the BOI Reporting exists to expand protection of the U.S. financial system and national security. Regarding financial protections, it’s to further reduce illicit practices such as hiding or laundering money and hiding assets. Regarding security, the illicit operations can also do harm to our overall nation’s stability, such as drug operations, fraud (informational, financial, etc.), bypassing international sanctions, & many others.

What is a Shell Corporation or Shell Company?

The creation & use of Shell Corporations, aka “Shell Companies” can be for either legal, appropriate reasons or for illegal or deceptive reasons. Often, the initial usage of creating a shell corporation is to gain funding through investments like for startups or other short durations less than a few years. However, they also can exist on a longer term.

Here’s more about shell companies. Also, be aware this does not have anything to do with the oil and fuel global company brand known literally as the “Shell Corporation”.

- Shell Corporation (Investopedia)

- Shell Corporation (Wikipedia)

About BOI Rules For the BOI Report

There are laws, regulations, and BOI Rules. With this in mind, “Proposed Rules” and “Final Rules” are listed in the FINCen BOI Reference Materials . One of the easier links to review is the BOIR Rule Fact Sheet. To this end, it has good details for reviewing. Also, it has the definition of a “beneficial owner”. Finally, it talks about the types of domestic and foreign companies required for filing BOIR.

Blog Business Filing for BOI Report

Basically, the BOIR is a requirement of many companies, including LLCs, starting January 1, 2024. However, exceptions are mentioned on https://www.fincen.gov/boi. But, check further to see if you are or are not required to file.

Also, understand that you can file this yourself for free. Or, just pay to have your trusted contracted business services do it for you if that’s in their offered services. Also, use extreme caution in choosing a service or individual. What’s more, there are scams happening on this report filing service topic.

Keep reading to see the steps to follow and the information required in advance.

When ready, it’s very simple to do yourself, as I have done. So, keep reading to see the information required and the steps to follow.

Popular Questions About BOI Reporting Filing

What Does Filing The BOI Report Cost?

If you file it yourself, it’s free. If you pay for a service, it will be based on their charges. Keep reading to be aware of scammers on this popular topic.

Who Can File BOI Report For My Blog Business?

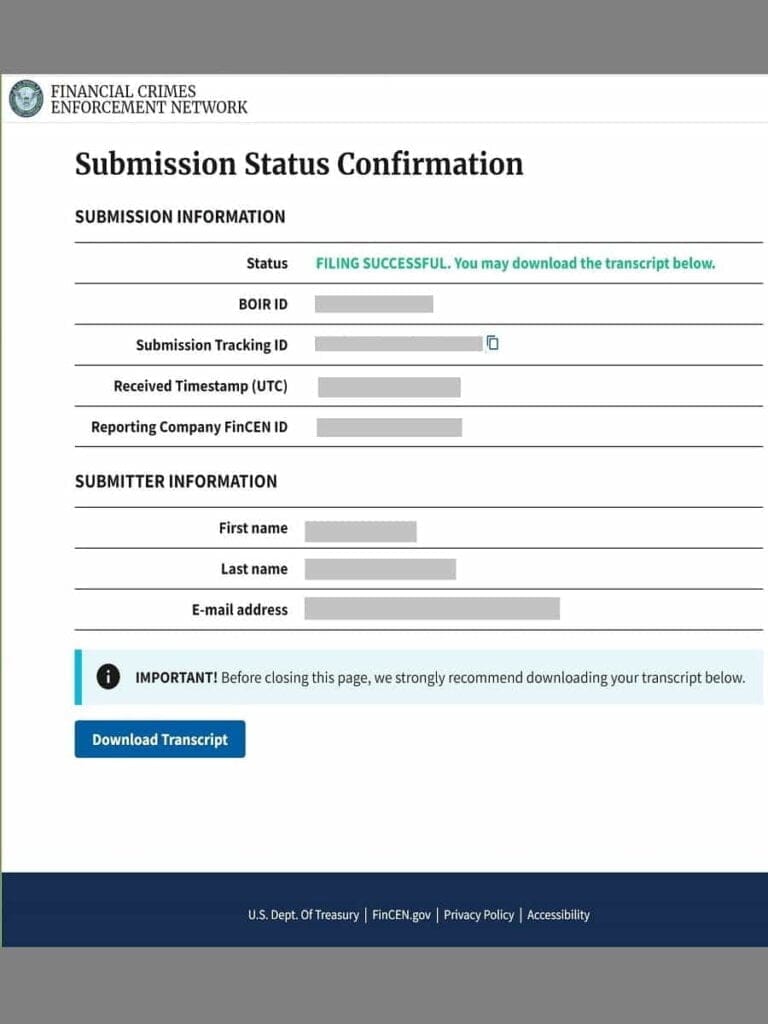

You can or anyone you delegate to act on your company’s behalf can file the BOI Report. For example, an employee, any owner, or your 3rd party service you’ve chosen. It’s up to you, however, to ensure it was done and completed properly. When filed, there’s a status report available for immediate download. So, review it for the data entries made during the filing.

Do I need to re-file BOIR every year?

As of November, 2024, after your initial BOIR submission status was marked successful, you only re-file when there’s a business change or a change with any people involved in key ownership or control. However, to be certain, check for guidance at least through the FinCen BOIR Help page.

How To File BOI Report Yourself Online For Business Step-By-Step

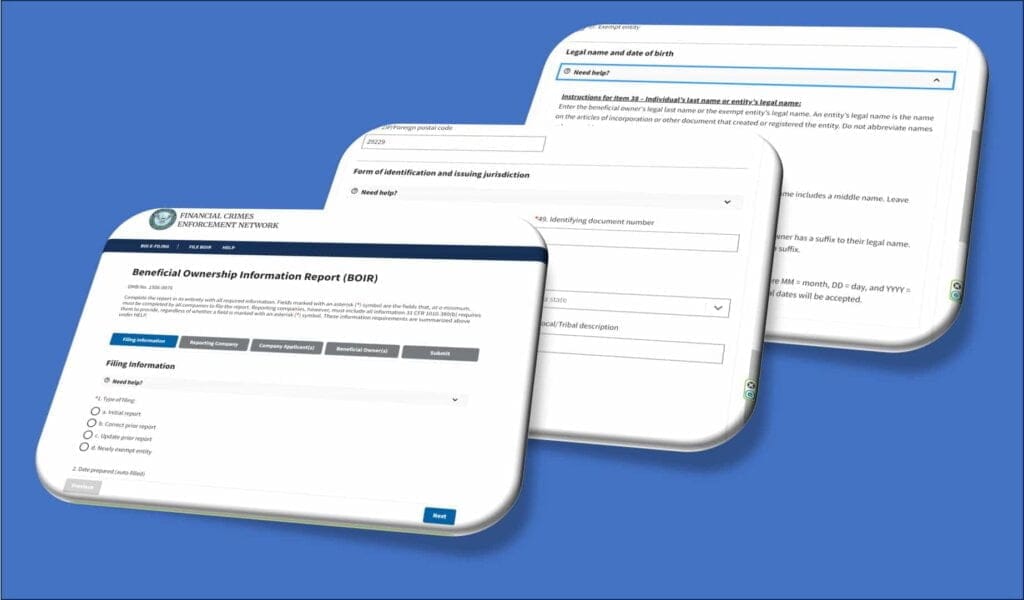

To demonstrate how to file the BOIR yourself, below are some screenshots with notes I used when I filed. Of course, screens & steps are subject to change. Also, here’s small business guidance on how to file the BOI Report. When submitted at the end, you get a status confirmation right after filing.

BOIR Filing Information Tab

Start Here To File Business Ownership Information Report Online

- When ready, visit FinCEN’s BOI E-Filing website: https://boiefiling.fincen.gov.

- After that, select <File BOIR> to start.

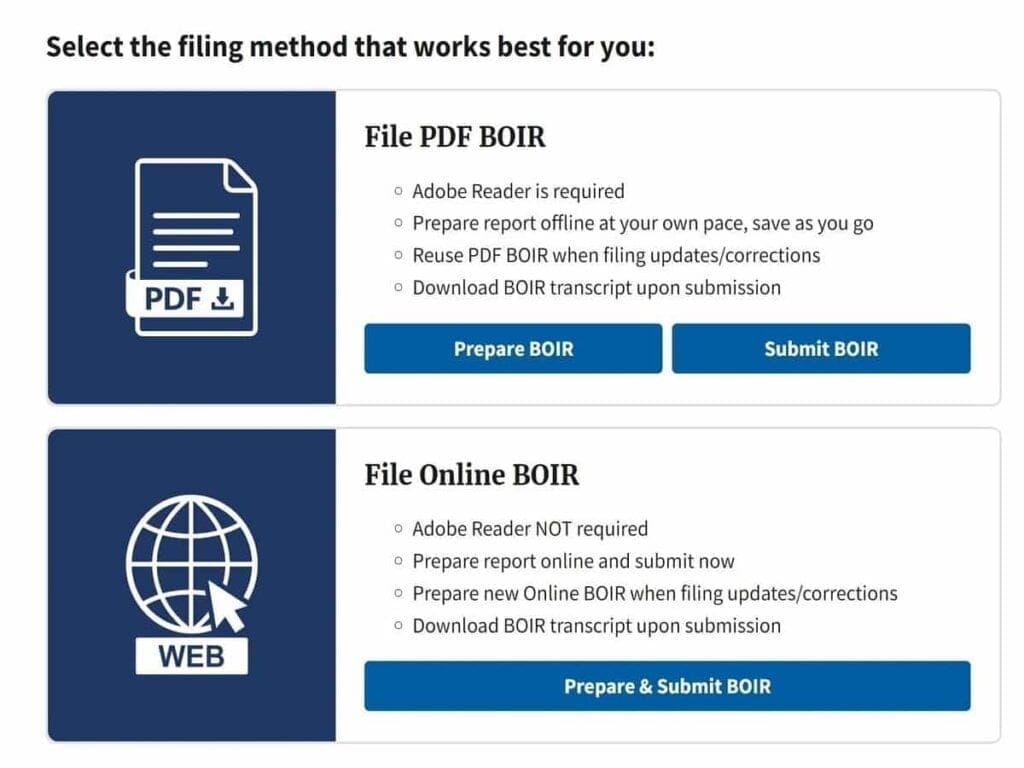

- Then, see section named “File Online BOIR”. At this time, tap <Prepare & Submit BOIR>.

Go to FinCEN site. See “File Online BOIR”. Tap <Prepare & Submit BOIR>.

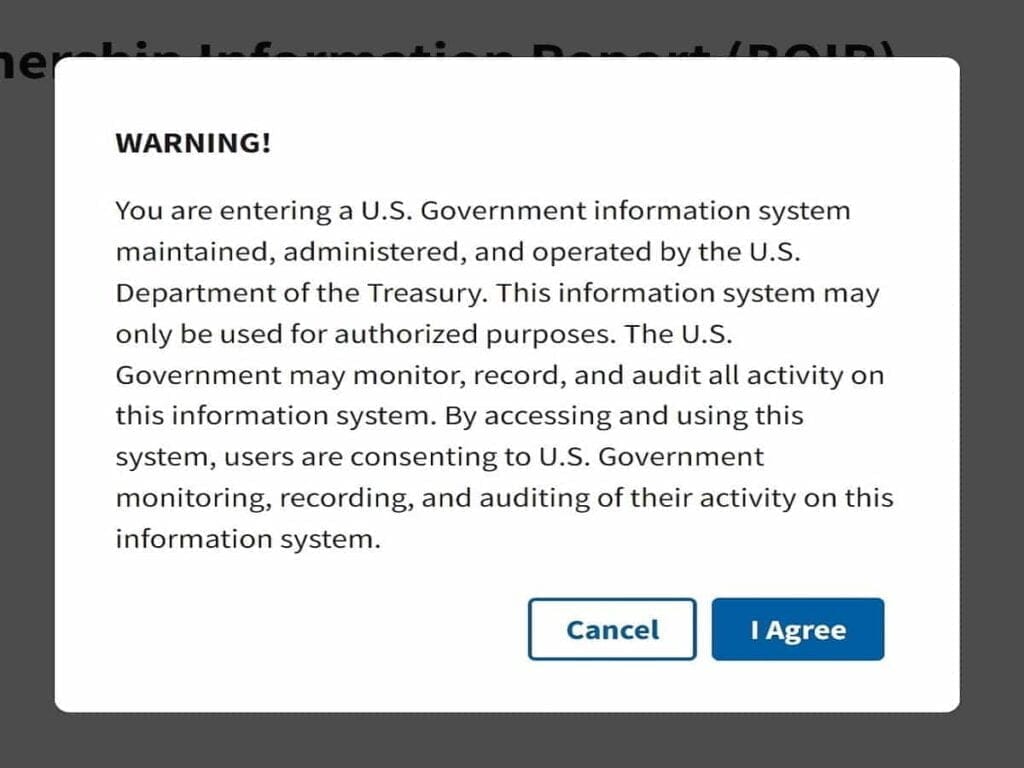

- Read, understand, and tap <I Agree> to prompt.

Tap <I Agree> to prompt to continue.

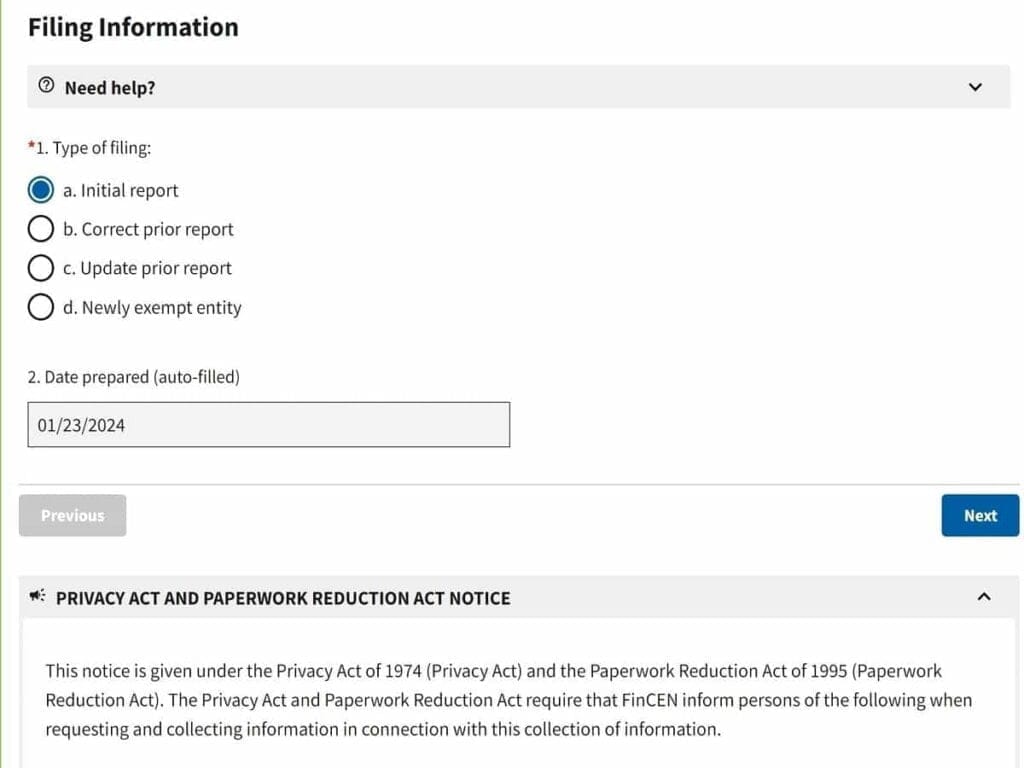

- 1. Select the “Type of filing”. This entire post is for new filers so, respond with “Initial report”.

- 2. The “Date prepared” is automatically filled in.

- Their system uses UT (Universal Time) so, the date shown might be different by 1 day.

- Then, press <Next>.

Select “Initial Report” and <Next>.

BOIR Reporting Company Tab

BOIR Questions 3 through 4

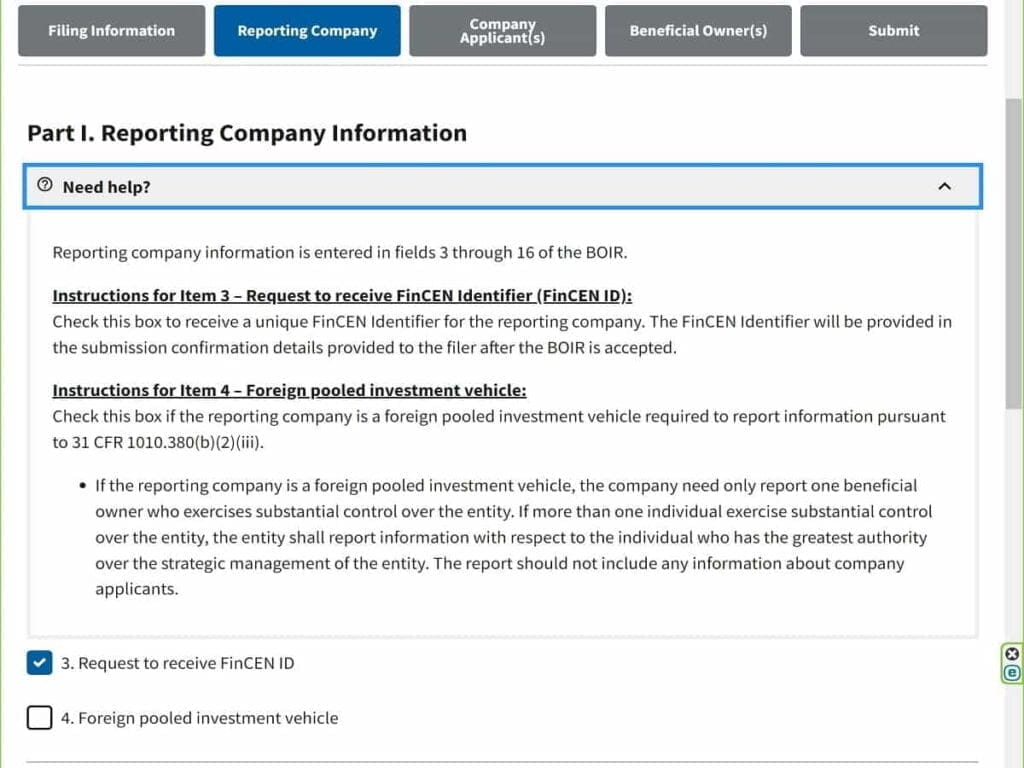

3. Select to “Request to receive FinCEN ID”, if you don’t already have one for this company. Since this is your initial report, you’ll select it.

Tip: Also, know that some questions will have a <Help> indicator. Thus, tapping it will expand and show further guidance. So, this is helpful in understanding the question in more detail.

4. If “Foreign pooled investment vehicle” applies, then select it. So, with my simple blogging business case, I didn’t check it.

Questions 3 & 4. Requesting an ID and Foreign pooled investment

BOIR Questions 5 through 6

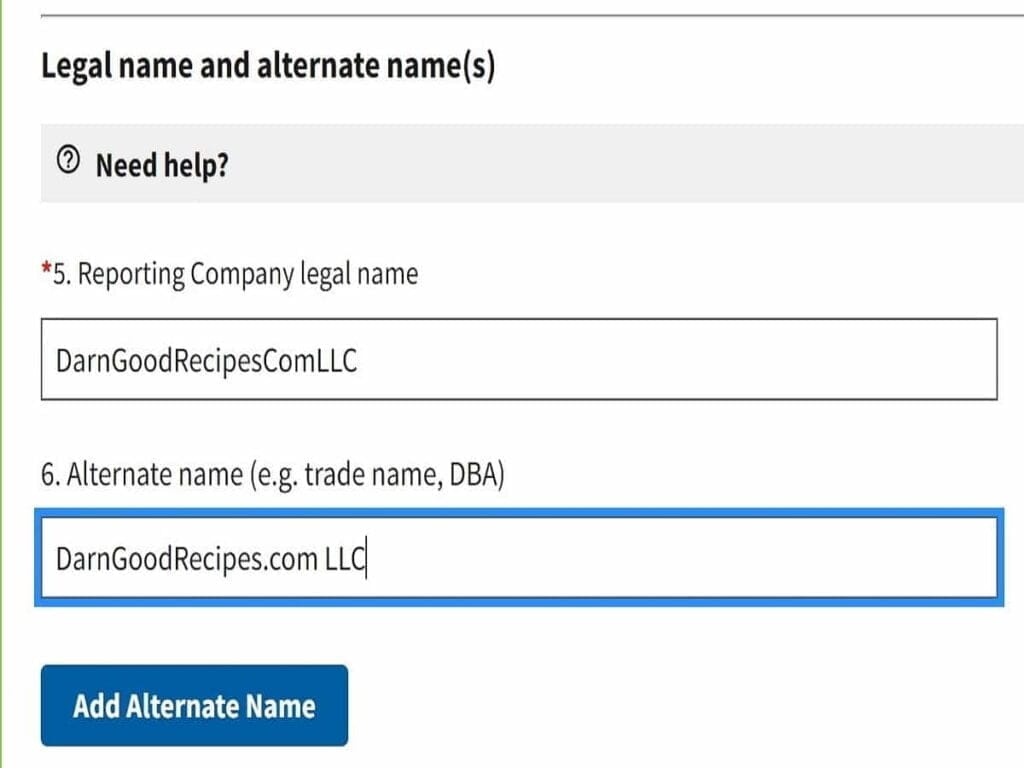

- Legal name and alternate name(s) section. So, I’ve shown my example entries I used for my blog business.

- 5. Then, Fill in your “Reporting Company legal name”. That’s the name assigned by the federal government when you were assigned your EIN, for example.

- 6. Next, you get to fill in other names your company goes by, e.g., DBA or trade name).

- If you have more than one alternate name,, tap <Add Alternate Name> and it will give you a place to add another one. Continue to tap the button again for further names to add individually.

Questions 5 & 6. Company legal name and alternate names.

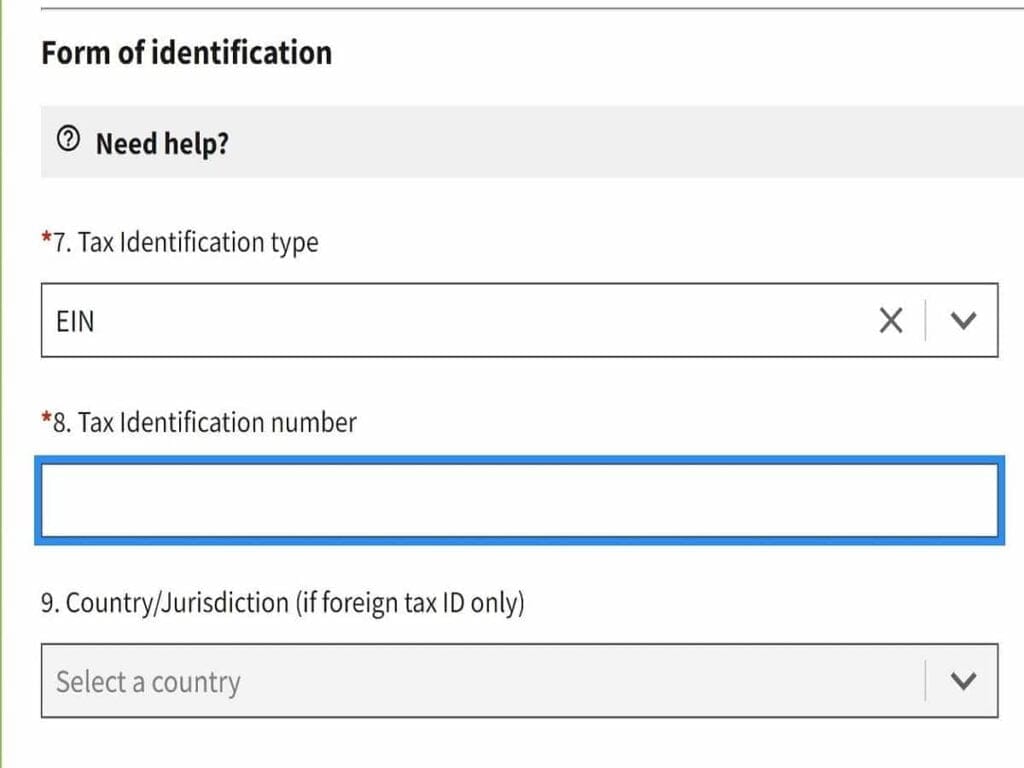

BOIR Questions 7 through 9

- Form of Identification section (for company). So, the most popular is going to be your company EIN received from the federal government.

- 7. Now, select the type of ID you choose to use that you have on your company. For example, I chose the “EIN”.

- 8. Then, fill in the ID info that applies to the type of ID you chose in the previous question.

- 9. If it’s a foreign country company, select the country. Otherwise, if U.S., do nothing.

Questions 7 – 9. Company ID Type (e.g., EIN), Number, & Country.

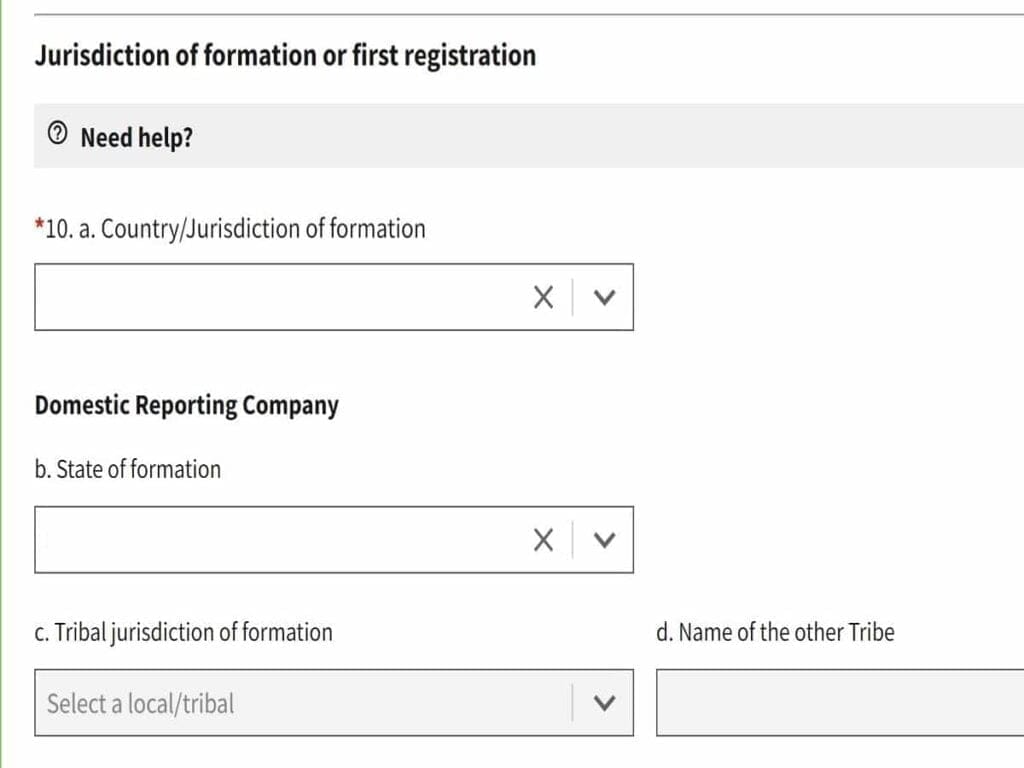

BOIR Questions 10a through 10d

- Jurisdiction of formation or first registration section.

- 10a. Select the Country/Jurisdiction of company formation. For mine, I selected the U.S. So, the following is available under the section named “Domestic Reporting Company”.

- b. Select your State of formation. For example, in my case, I created the company in South Carolina.

- c & d. So, these refer to Tribal selections.

10. Country / Jurisdiction of company formation

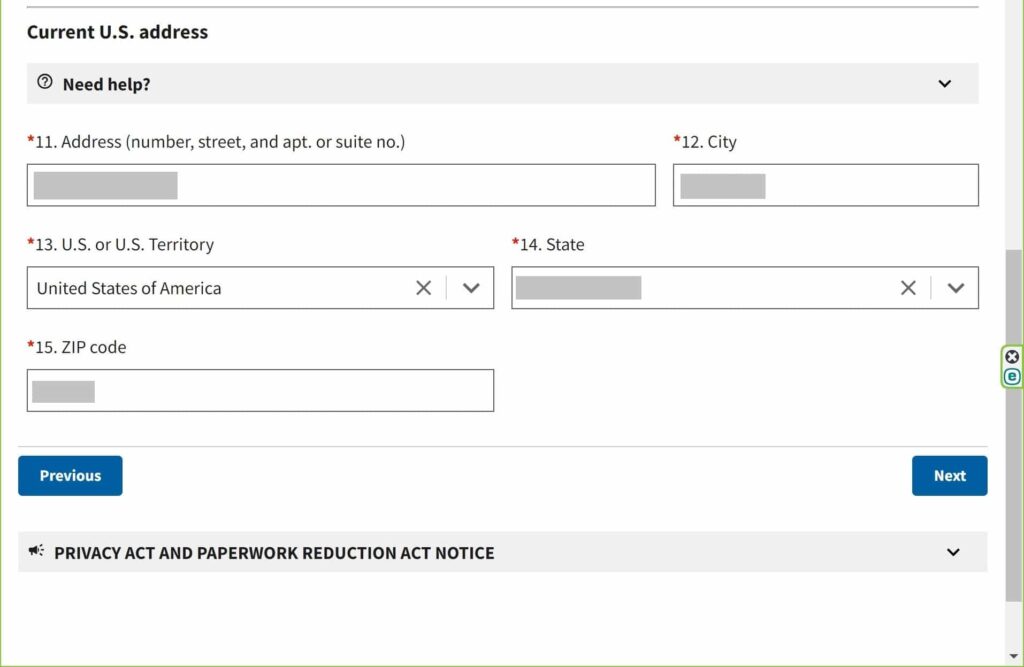

BOIR Questions 11 through 15

- Current U.S. address section.

- 11-15. So, these are just common street address entries for the company. In my case, I listed my company address as it exists today.

- Then, tap <Next>.

Questions 11-15 are basic company address entries.

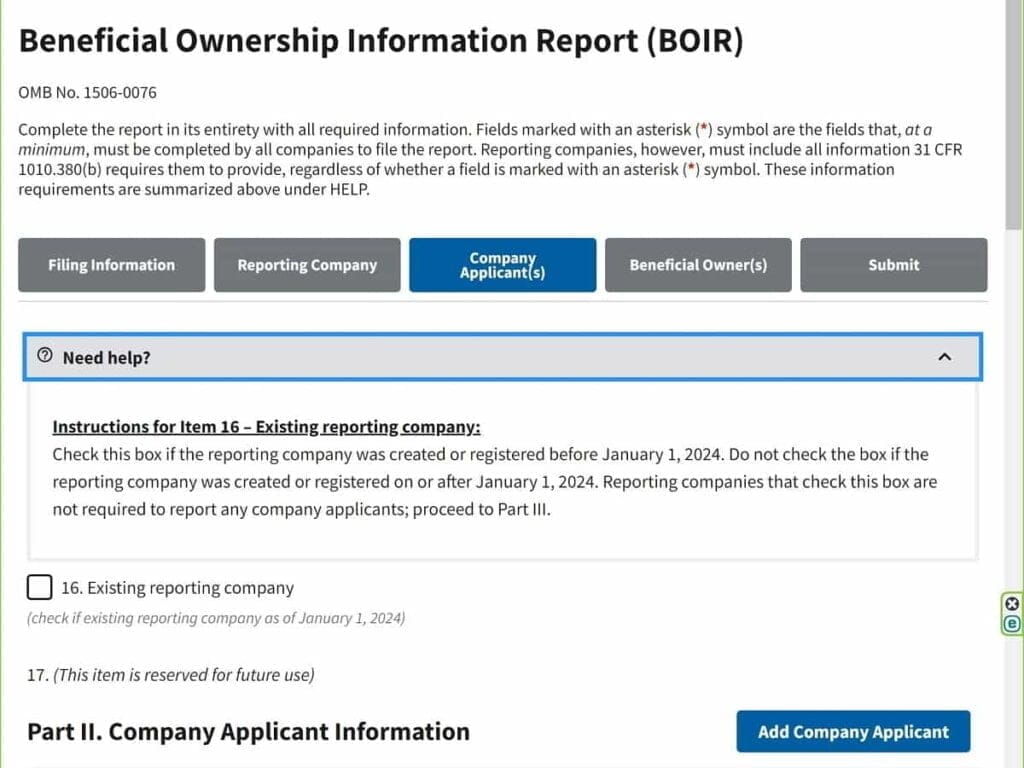

BOIR Company Applicant Tab

BOIR Questions 16 through 17

- 16. Basically, this is a question asking if your company already legally existed before Jan. 1, 2024.

- So, if your company didn’t finalize legal existence (didn’t yet receive federal ID number, (e.g., EIN), legal name, etc.) before year 2024, you don’t check the checkbox.

- Then, you proceed to scroll down and fill in Part II: Company Applicant Information. These questions are not covered in this article but they are simple questions.

- If you check this checkbox for your company existing before year 2024, you’ll get a prompt, asking to confirm. In my case, I checked “Yes” to continue because my company had received its legal name and federal EIN number dated before year 2024.

- Then, you’ll tap <Next> to continue.

- So, if your company didn’t finalize legal existence (didn’t yet receive federal ID number, (e.g., EIN), legal name, etc.) before year 2024, you don’t check the checkbox.

- 17. So, this is for future use by FinCEN.

Question 16. Selection if company already legally existed before year 2024.

BOIR Questions 18 through 34

Part II: Company Applicant Information. This section is skipped if your company existed before year 2024 and if you selected that option in question 16 earlier. If that’s the case, move on to the next section below. Otherwise, if not, these questions are simple ones that are similar to when you filed to create your company. Therefore, they’re not covered in this article.

BOIR Beneficial Owner(s) Tab

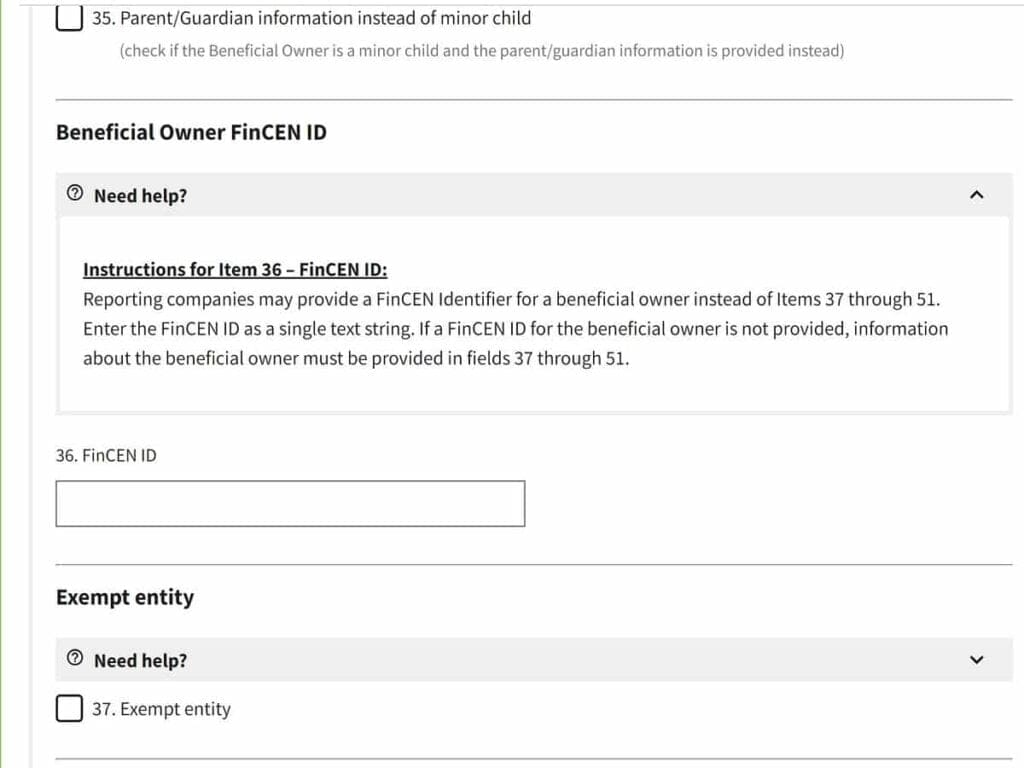

BOIR Questions 35 through 37

- Beneficial Owner FinCEN ID section

- 35. This remains unchecked unless you’re filling in information for a minor child who is a beneficial owner.

- 36. Then, the FinCEN ID text box remains empty since you don’t have one yet because this is your initial filing. However, this box is available for those who are filing a BOIR that is not their initial filing. Also, there might be companies that have a FinCEN ID for other reasons prior to this filing.

- Exempt entity section

- 37. Exempt entity checkbox remains unchecked unless you have confirmed legally you are exempt. In my case, I did not check this checkbox.

Questions 35-37. These entries are unique for each company.

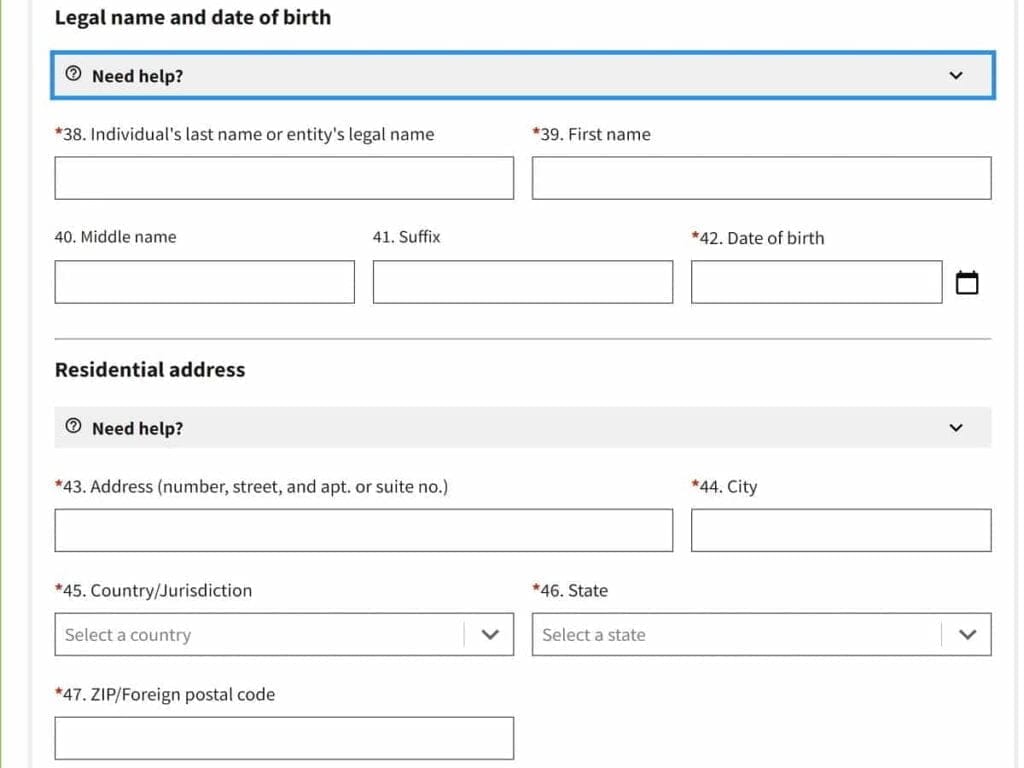

BOIR Questions 38 through 51

- Q38-47. These are initial simple questions regarding legal name, date of birth, and residential address of one individual beneficial owner.

Questions 38-47. Initial identifying information on each beneficial owner.

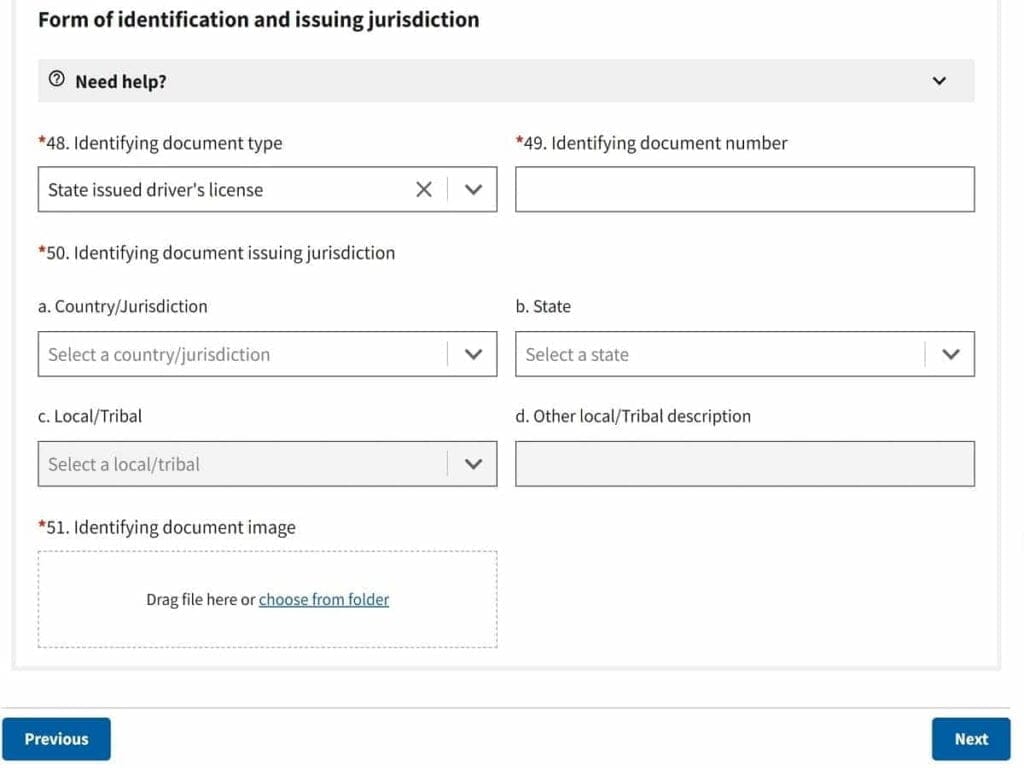

- Q48-51. Continuing, this identifying information is regarding a legal form of identification and issuing jurisdiction. For example, drivers license information.

- You’ll need to plan ahead and have an image of the front of the ID to upload.

Questions 48-51. Legal ID of each beneficial owner, e.g., drivers license.

- Then, after completing for one individual, tap to add another beneficial owner until all are entered. When all beneficial owners have been entered, tap <Next>.

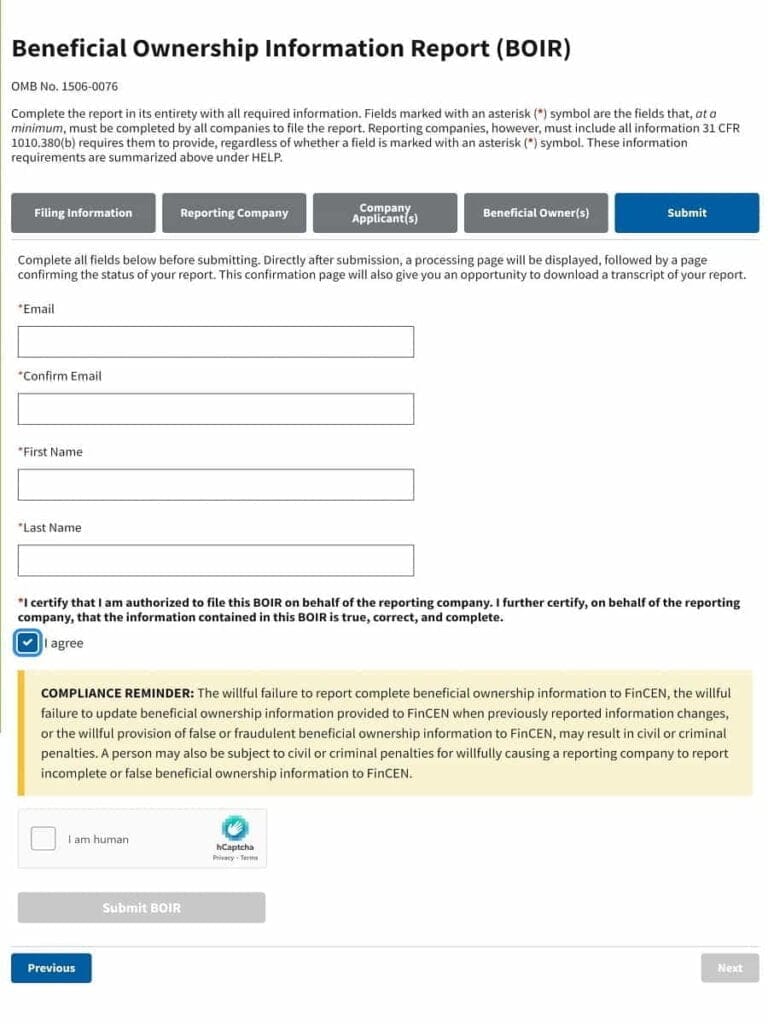

BOIR Submit Tab

Then, fill in the final data screen. It’s basic information about the person that’s submitting this BOIR. Also, this is the person who will receive the status report.

- So, just fill in the basic information.

- Then, tap the agree checkbox.

- After that, tap the “I am human” checkbox.

- Then, you’ll need to respond to a type of human response manual verification.

- After that human verification, tap the now enabled <Submit BOIR> button.

- There will be a short processing delay, potentially about a minute or less. Finally, you’ll see a status confirmation prompt.

Finally, the easy to fill BOIR Submit screen.

Confirmation Status Received

After submitting, you’ll receive a screen of a confirmation status. Tap the <Download Transcript> button and save the PDF file. After it’s downloaded, open it to confirm it’s a good, working file you can open. Finally, you can close your browser.

It’s recommended to print out a hard copy or to duplicate the file as a backup. On this status report, you’ll see you now have been assigned a FinCEN ID and also a BOIR ID. At the very top, you’ll see if your BOIR filing status was successful or if there were any issues to address.

Example of a successful BOIR submission status report

BOI Reporting Compliance Guide

In case you need it, here’s the post that lists the BOI Reporting Compliance Guides in multiple languages, including English.

Scams on BOI Reporting Services

So, if you choose a service or individual, be very cautious about some scams related to BOIR. Some people might mistype a URL and end up on a scam site.

When looking for the latest information, it’s better to use a site URL that ends in “.gov”. Look at your browser’s address bar and ensure you landed onto a “.gov” site where the URL “ends with .gov“. A big trick is to have you end up on a domain name that has “.gov” in it but it doesn’t END with “.gov”. So, that means on phones too. In general, scammers are betting that most phone users don’t check their URLs where they landed and they might be correct!

So, scam BOI sites wanting payment for filing might take no action on your behalf and never file the BOIR. Also, they might grossly overcharge your card. Finally, they will have a ton of identifying information.

There are many 3rd party services offered to file the BOIR for you. So, if unsure, the best course of action is not to use them. I will not begin to suggest any.

Security Tip: Never use a debit card for online purchases. Debit cards often don’t have the same protections, if any, compared to using a credit card.

How To Stay Updated on BOI Reporting Requirements

At this point, here’s a “GovDelivery” link to receive FINCen Updates to BOIR requirements and related information. It does continue, however, and offer updates to a long list of many other government topics and guidance as well. I elected to select an additional 1 or 2 items for updates but that’s up to you, of course.

Videos About BOI and FinCEN

See below for links to videos related to BOI reporting and the FinCEN (Financial Crimes Enforcement Network).

- YouTube Channel of Videos from FinCEN and subject of BOI

Conclusion of BOI Reporting

Finally, you’ve reviewed about the BOI Report & BOI Reporting requirements. Also, you’ve read about its purpose & have seen the link for filing it yourself. It’s very easy and you can get government updates about it on a link also provided. I did mine in about 40 minutes but, I wish I had this guide to use. So, tell me how your filing went in the comments.

Also, with the confusion to the public due to the frequent Federal Court decisions back and forth, read the latest in our daily maintained article called “Is BOI Filing Still Required?“.

*Disclosure: I am a retired Federal IT Manager of a Law Enforcement Agency. I am not an attorney, accountant, nor currently in law enforcement. Basically, the content provided is for information purposes. Overall, it shows summaries & examples of my research. It also shows parts of what I did to file my own BOIR. It is solely up to you in what process you follow and when you do it. Also, in this article, there are plenty of government links provided directly related to this topic. Finally, your results may vary.